Roadmap to Getting Started In Real Estate Investing

The post Roadmap to Getting Started In Real Estate Investing appeared first on REtipster.

Wondering how to get started in real estate investing but not sure where to begin?

Take your pick among reasons for getting into real estate investing: passive income, diversification from stocks, inflation-resistant assets, tax benefits, and long-term appreciation. You know you want real estate in your investment portfolio—now you just need to know how to get started.

Decide Between Active and Passive Investing

When most people think about getting into real estate, they think of either rental properties or flipping houses. But active real estate investing requires plenty of work, money, and risk, so it doesn’t actually make the perfect starting point.

Ask yourself a simple question: Do I just want to diversify my portfolio to include real estate, or is it important to me to buy properties directly?

If you just want to diversify your portfolio, consider passive investing instead. Even if you eventually do want to buy properties directly, it still often makes sense to get your feet wet with passive real estate investments. These come in many varieties, but the three most common are public REITs, real estate crowdfunding, and real estate syndications.

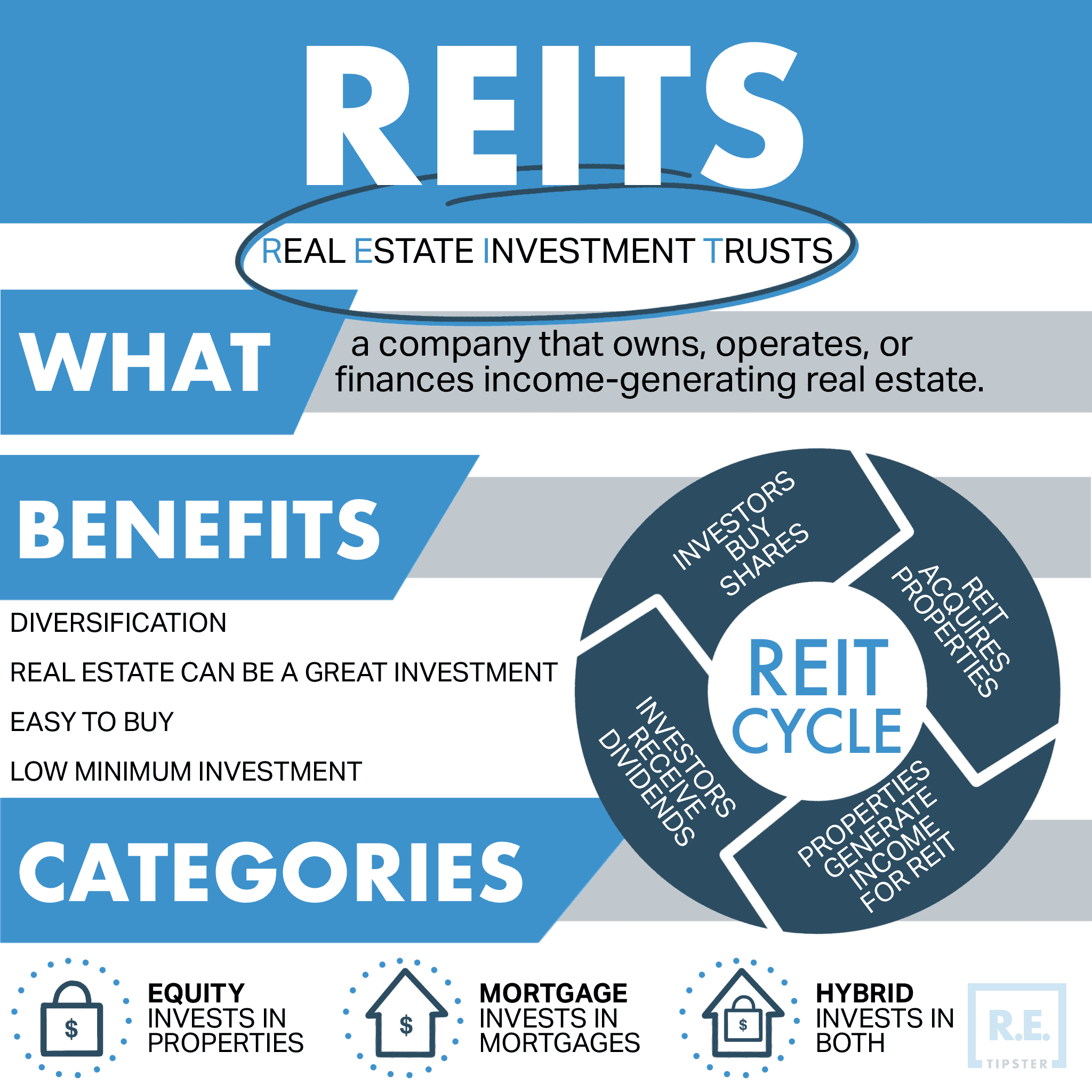

REITs

The most popular passive real estate investment is publicly traded real estate investment trusts, better known as REITs.

You can buy and sell these through your stock brokerage, which has several advantages. First, you don’t need much cash to invest—you can buy a single share for the going price, often just $10 to $20. Second, shares are liquid, and you can buy or sell instantly at no cost. Finally, the SEC requires all REITs to pay out at least 90% of their profits each year in the form of dividends, so they tend to pay high yields.

For all those perks, REITs come with some equal and opposite downsides. The ease of investing on public stock exchanges leads to a closer correlation between REITs and stock markets than actual real estate values merit. That creates volatility and limits their value for diversifying away from stocks. It’s also all too easy for REITs to hide revenue and fees when they pay themselves for repairs, maintenance, and property management.

Real Estate Crowdfunding

Real estate crowdfunding platforms come with their own pros and cons.

First and foremost, you typically buy and sell investments directly with the crowdfunding platform. That limits liquidity, as many real estate crowdfunding platforms require you to wait three to five years or even longer before you can cash out your investments. If they do let you sell early, they often hit you with a penalty.

That lack of liquidity also means more stability and a low correlation with stock markets. In other words, they can offer true diversification from stocks.

Some crowdfunding platforms also require high minimum investments. That could mean anywhere from $500 to $25,000 or more. Others let you invest with $10 or $100.

If you’re interested in getting into real estate crowdfunding, check out Fundrise (Fundrise review), Groundfloor (Groundfloor review), Concreit (Concreit review), or Arrived (Arrived review) as easy starting points. All of these will let you start with just $10 to $100, and Groundfloor and Concreit offer short-term investments.

Real Estate Syndications

Real estate syndications often pay sky-high returns, in the 15% to 50% range. But they’re also harder to invest in than REITs or real estate crowdfunding.

To begin with, these private equity investments require a minimum investment of $25 to $100K. That’s a tall order for the average middle-class investor.

Even if you have that much ready to invest, many syndications don’t allow middle-class investors. For regulatory reasons, many can only accept investments from accredited investors.

Don’t expect any liquidity, either. Depending on the syndication, plan on leaving your money invested for three to seven years.

But if you can clear those hurdles, you can potentially earn high returns with full tax benefits—all without the headaches of becoming a landlord. To help you find syndication deals that allow non-accredited investors, check out Left Field Investors or SparkRental’s group real estate investment club. The latter lets investors pool funds in syndications so each person can invest $5K instead of $50K (I know because I’m a founder, for full disclosure!).

Choose an Investing Strategy

Still interested in getting into real estate as a direct buyer?

If you love the idea of active investing, your first order of business involves choosing a strategy. You could flip houses, of course, or invest in income properties. The latter include long-term and short-term rentals, turnkey properties, and fixer-uppers.

Or you could invest in “alternative” real estate investments like land, mobile homes, mobile home parks, or self-storage. If you don’t have much cash but still wonder how to start real estate investing, consider wholesaling as a gateway strategy.

Before just blindly diving into a strategy that you’ve heard of, research other investing strategies, and you may find you prefer land investing over long-term rentals or vice versa.

Start Building Your Network

Active real estate investing is a team sport. You need many relationships in place, including lenders, contractors, inexpensive handymen, real estate agents, home inspectors, property managers, and more.

Within those categories, you need a range of options. For example, you need plumbers, electricians, roofers, HVAC specialists, and foundation experts. You should have relationships with several lenders, possibly including short-term hard money lenders and long-term portfolio lenders.

The networking process never ends—you’ll keep adding contracts in perpetuity. So you might as well get started today if you plan on getting into real estate.

Dive Deep Into Your Niche

You already chose an investing strategy; now you need to learn everything you can about it.

If buying undeveloped land parcels at a tax sale is your niche, start reading blogs about it. Listen to podcast episodes. Watch webinars. Take online courses (Seth’s land investing course is the best in the industry, by the way).

Consider finding an experienced partner as well. They can show you the ropes, point out common pitfalls, and help you avoid expensive mistakes. And in exchange, they’ll likely take the lion’s share of the profits on the first few deals, while you do the grunt work.

Get over it. If it can save you $20,000 in losses, it’s worth it.

Do Your First Deal

There’s only so much learning and preparing you can do before it stops being prudence and becomes analysis paralysis. At a certain point when kids are learning how to swim, they have to just jump in the deep end. It’s the same when learning how to get started in real estate investing.

That doesn’t mean you should shirk your due diligence. Quite the contrary—double-check every number, get second opinions from experienced investors, review the legal contracts. But when a deal passes muster, take action on it.

None of the rest of what you’ve done until now counts as “getting into real estate.” It was groundwork, laying the foundation. The day you sign a purchase contract is the day you actually become a real estate investor.

After completing your first deal, pause and take stock. What went well? What went wrong? How can you do better next time? Wait at least a few months before doing your second deal, to give your mistakes a chance to rise to the surface. It took me several years to fully understand all my mistakes, and by that point I had bought over a dozen properties. What could have been a few thousand in losses compounded into hundreds of thousands.

Scale

Your fifteenth deal won’t look anything like your first. Over time, your investing strategy will grow and evolve, as you gain experience and learn from your mistakes.

Keep pausing after each deal to do a post-mortem analysis of it. Keep learning from your mistakes and your successes alike. And of course, keep growing your network.

Many investors find themselves buying bigger and bigger properties. Some start with single-family homes and then move on to 2- to 4-unit residential properties and then on to commercial multifamily properties with five or more units. Others stick with smaller properties but scale up their speed of acquisition.

There are no right or wrong ways to invest in real estate—just profitable or unprofitable ways. As you become more experienced, you’ll learn to maximize profits and minimize risk.

Final Thoughts on Getting Into Real Estate

Anyone can learn how to get started in real estate investing.

It doesn’t take an expensive education or family connections. But it does take self-discipline, intrinsic motivation, and the humility to get help from others who know more than you do.

Start learning before you start earning, and never stop.

The post Roadmap to Getting Started In Real Estate Investing appeared first on REtipster.

What's Your Reaction?